Understanding wealth distribution can be eye-opening, especially when looking at the top 1 percent net worth in the UK. These households hold a significant share of the nation’s wealth.

This article explores what it takes to join this exclusive group and what it means for wealth distribution in the UK. Whether you’re concerned about income inequality or aspiring to reach the top 1%, these insights offer a clearer picture of the numbers behind the divide.

What it means to be in the UK’s top 1% by net worth

If you are in the top 1% of households in the UK by net worth, you belong to an exclusive group that:

- Represents approximately 263,000 households in Great Britain.

- Holds a significant share of the nation’s total wealth.

- Has more wealth than 70% of the rest of the population.

- Benefits from pension wealth as the largest component, with pension assets of around £2 million.

What net worth puts you in the top 1% in the UK?

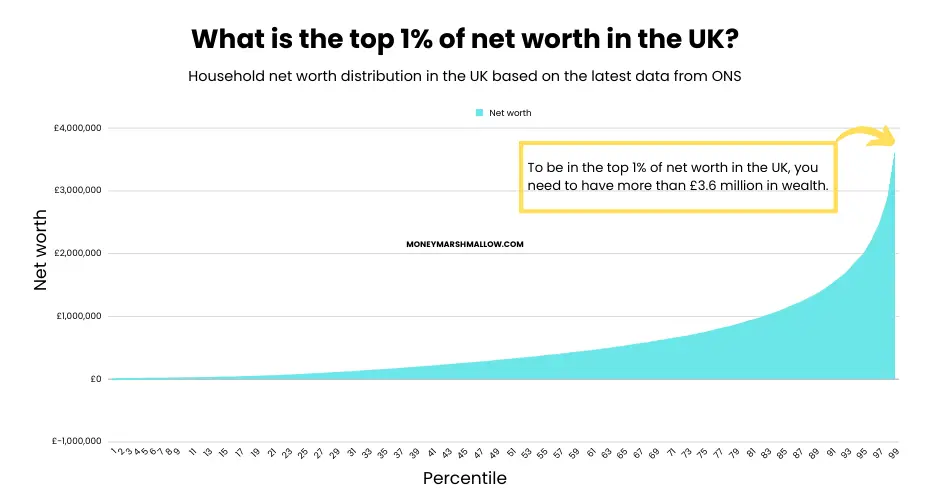

The latest available data from the Office for National Statistics (ONS) Wealth and Assets Survey (2018-2020) found that households in the top 1% had a net worth over £3.6 million. This includes property, pensions, investments, and savings, minus any debts.

However, since 2020, rising property prices and stock market growth suggest, that the more realistic figure for the top 1 percent net worth in the UK is currently closer to £4 million or even higher.

How is wealth distributed in the UK?

| Wealth Group | Net Worth (£) |

|---|---|

| Top 1% | Over 3.6 million (∼4 million today) |

| Top 2% | Over 2.5 million |

| Top 5% | Over 1.4 million |

| Top 10% | Over 800,000 |

| Bottom 50% | £302,500 |

| Bottom 10% | £15,400 or less |

The median household wealth in Great Britain, however, was approximately £302,500 during the 2018-2020 period. This figure is heavily influenced by the wealth of the top 10%, especially the top 1%, which skews the average higher.

Median wealth by age group in the UK

While there is no official UK data on the top 1% net worth by age, the following table shows the total wealth for different age groups, highlighting how wealth accumulates over time. Median wealth represents the middle point in wealth distribution, meaning that half of households have wealth above this amount, and half have wealth below it.

| Age Group | Total Wealth (£) |

|---|---|

| 16 to 24 years | 22,300 |

| 25 to 34 years | 76,800 |

| 35 to 44 years | 198,100 |

| 45 to 54 years | 366,600 |

| 55 years to under State Pension age | 553,400 |

| State Pension age and over | 468,700 |

This table illustrates how, on average, wealth grows as individuals age, with a significant increase seen in the 25-34 and 35-44 age ranges, continuing through to the 55+ age group.

Related: Are You Considered Rich in the UK? Here’s How to Know

Wealth inequality in the UK

The wealthiest 1% hold more wealth than the bottom 80% combined. The wealthiest 10% own 43% of all wealth, while the bottom 50% hold only 9%.

Pensions and investments widen this gap. The top 1% have an average pension wealth of £2 million. In contrast, the poorest households in the bottom 10% have little to no savings. For example, the least wealthy 10% have a wealth of £15,400 or less. Over half of this wealth is in physical assets, like property. Many in this group also have more debt than assets, actually making their net worth negative.

Property wealth and physical assets are mainly owned by the richest households. For poorer households, physical assets make up the majority of their wealth. For wealthier households, pensions are the largest component.

Organizations like Oxfam’s Fight Inequality Alliance and Patriotic Millionaires advocate for policies to reduce wealth gaps. They call for higher taxes on the wealthy and big corporations. Their goal is a fairer distribution of wealth.

These disparities also affect financial resilience. Wealthier households can afford private education and more opportunities. The poorest face greater challenges, making it harder for younger people to climb the wealth ladder.

What is considered high net worth?

In the UK, a “high net worth” typically refers to having £1 million or more in liquid assets, excluding the value of one’s home. Ultra-high-net-worth individuals (UHNWIs) have assets of £30 million or more. The top 1% often overlap with these categories, but their wealth is typically tied up in assets such as real estate, stocks, businesses, and pensions.

Factors driving wealth growth in the UK

Several factors have contributed to the growing wealth of the top 1% in the UK:

- Property: Rising property prices, especially in areas like London and the South East, have significantly boosted wealth for homeowners and property investors. Homeownership remains one of the main components driving wealth for many top earners.

- Pensions: Private pensions are a cornerstone of wealth for many in the top 1%, with the median pension assets for these households exceeding £2 million. Pensions provide a long-term source of wealth and often contribute more significantly to net worth than income alone.

- Investments: Stocks, mutual funds, and hedge funds have grown in value, contributing to the increasing wealth of the top earners. These financial assets are often more accessible to wealthy households, allowing them to accumulate wealth at faster rates than the average person.

- Entrepreneurship: Business ownership and capital gains play a major role in wealth accumulation for many in the top 1%, who often derive their wealth from successful ventures and private investments.

What income puts you in the top 1%?

Income and wealth are closely linked but not the same. To be in the top 1% of earners in the UK, you need to make over £199,000 per year before taxes. In comparison, the median income for full-time employees is £37,430.

Being a top 1% income earner doesn’t mean you have a top 1% net worth, and vice versa. Wealth is often built through investments, property, and inheritance, not just salary. For example, someone may have significant wealth from property or stocks but earn a modest income. Official data measures income as salary or wages, not capital gains, dividends, or business income. These assets contribute to wealth but are not counted as “income.”

It’s also worth noting that official data measures net worth by household and income by individual.

How does the top 1% net worth in the UK compare to other countries?

The top 1% threshold in the UK is relatively modest compared to some other wealthy countries. Let’s explore how the UK compares to the rest of the world based on data from the Knight Frank Wealth Report 2024:

- Monaco: Tops the list globally, with the top 1% requiring a net worth of $12.9 million (∼£10 million). This reflects its status as a luxury hub with unparalleled wealth concentration.

- United States: The threshold stands at $5.8 million (∼£4.5 million), though other sources suggest it could be closer to $13 million.

- Switzerland: Known for its financial stability, the top 1% need over $5 million (∼£4 million).

Some other affluent nations have lower thresholds for the top 1%:

- France: Requires $3.3 million (∼£2.6 million) to join its wealthiest elite.

- Spain: The threshold is $2.4 million (∼£1.9 million).

- Japan: A net worth of $2 million (∼£1.5 million) secures a place in the top 1%.

The UK aligns closely with European averages, highlighting stark contrasts in global wealth distribution and the economic factors influencing them. From property values to financial systems, these differences shape the varying definitions of being among the world’s wealthiest.

How to obtain the top 1% net worth in the UK

Reaching a top 1% net worth in the UK involves a combination of strategic financial decisions, entrepreneurship, and in some cases, luck and family wealth. Here are common paths to achieving such wealth:

1. Inheritance

Many of the richest people in the top 1% inherit significant wealth. This often includes assets like property, investments, or family businesses. Inheritance allows individuals to benefit from accumulated family wealth, providing a strong foundation for reaching the top 1%.

2. Building a business

Starting and scaling a successful business is one of the most common ways to amass significant wealth, especially for those without family wealth. Historically, wealth was passed down through generations, but with the rise of digital opportunities, it’s easier than ever for individuals with no family wealth to get started.

3. Investing

Strategic and consistent investing in stocks, bonds, or real estate can accumulate substantial wealth. Shareholders often build wealth by holding onto appreciating assets, such as property or equity in high-growth companies. For example, long-term property investments can yield significant returns. However, to reach the top 1% net worth, you need a considerable amount of disposable income and/or the ability to invest over a long period for the money to compound

4. Real estate ownership

Real estate has been a consistent path to wealth, especially for those who invest early. Property wealth is a significant component of net worth for the top 1%. Rising property values, particularly since the financial crisis, have contributed to a large decrease in affordable housing for lower incomes, while significantly boosting wealth for property owners.

5. Lottery winnings

While winning the lottery is extremely unlikely, it can immediately elevate someone to the top 1%. However, this is purely a matter of luck, not strategy, and doesn’t reflect long-term wealth-building like other paths mentioned here. In fact, very few lottery winners can maintain their wealth long after they win.

6. High-income career

High earners can reach the top 1 percent net worth in the UK with the help of high-paying jobs. However, top executives or professionals with top incomes still need to invest and manage their money wisely to maintain and grow their wealth. High earners also tend to be part of an affluent social circle, with access to opportunities that help increase their wealth.

Related: How the “Rich Friends Effect” May Help You Build Wealth

7. Tax planning

Many top earners and high-net-worth individuals use tax-efficient strategies to retain more of their wealth. Some relocate to tax havens or employ legal methods to reduce their tax burden. This practice helps preserve wealth, which can then be reinvested into growing assets.

8. Investment in education

Wealthy households often prioritise education, sending their children to private schools or top universities. This provides access to high-paying careers and influential social circles, contributing to long-term wealth accumulation. However, investing in education is not exclusive to the top 1%, as a third of families with children in private schools in the UK have below-average incomes.

Conclusion

To join the top 1 percent net worth in the UK, you need assets exceeding £3.6 million. However, this figure has likely risen to at least £4 million since the latest ONS data was published in 2020.

This threshold reflects a combination of rising property prices, robust investment growth, long-term wealth accumulation, and tax planning strategies.

Property ownership, pensions, and investments are key to wealth accumulation for the richest households. These assets help explain why the top 1% continue to see their wealth grow, even as income inequality remains a major concern for many.

One sees problems ahead as the Poor begin to realise the Inequilibrium .

No comments:

Post a Comment