After soaring more than 1000 points in nine months, the stock market was always ripe for a pull-back. Since its May high, it has fallen 9 per cent and may have further to go as concerns about Cyprus and Europe rattle investors. A deeper sell-off will be a buying opportunity.

One can easily be seduced by market “noise” and ignore long-term trends. This market is heading significantly higher in the next few years, albeit with recurring bouts of volatility. My hunch is we are just in the first of three bull-market stages – expectations of rising corporate earnings.

With uncertainty so high, the best strategy is to buy more stocks when the market dips by 5 per cent or so and to invest with at least a three- to five-year perspective. Buying into market weakness especially suits long-term investors, such as those with self-managed superannuation funds.

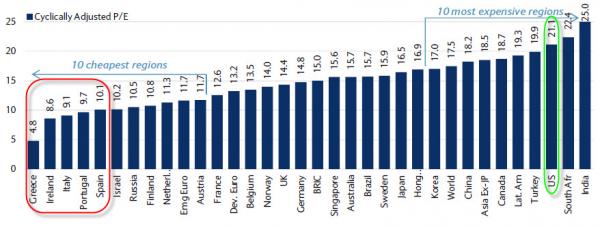

To find value always use the historical perspective .

May your Prophet go with you.

No comments:

Post a Comment